Office Hours

After Hours by Appointment

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health, Pet

Other Products

Banking, Annuities

Charity Andersen

Office Hours

After Hours by Appointment

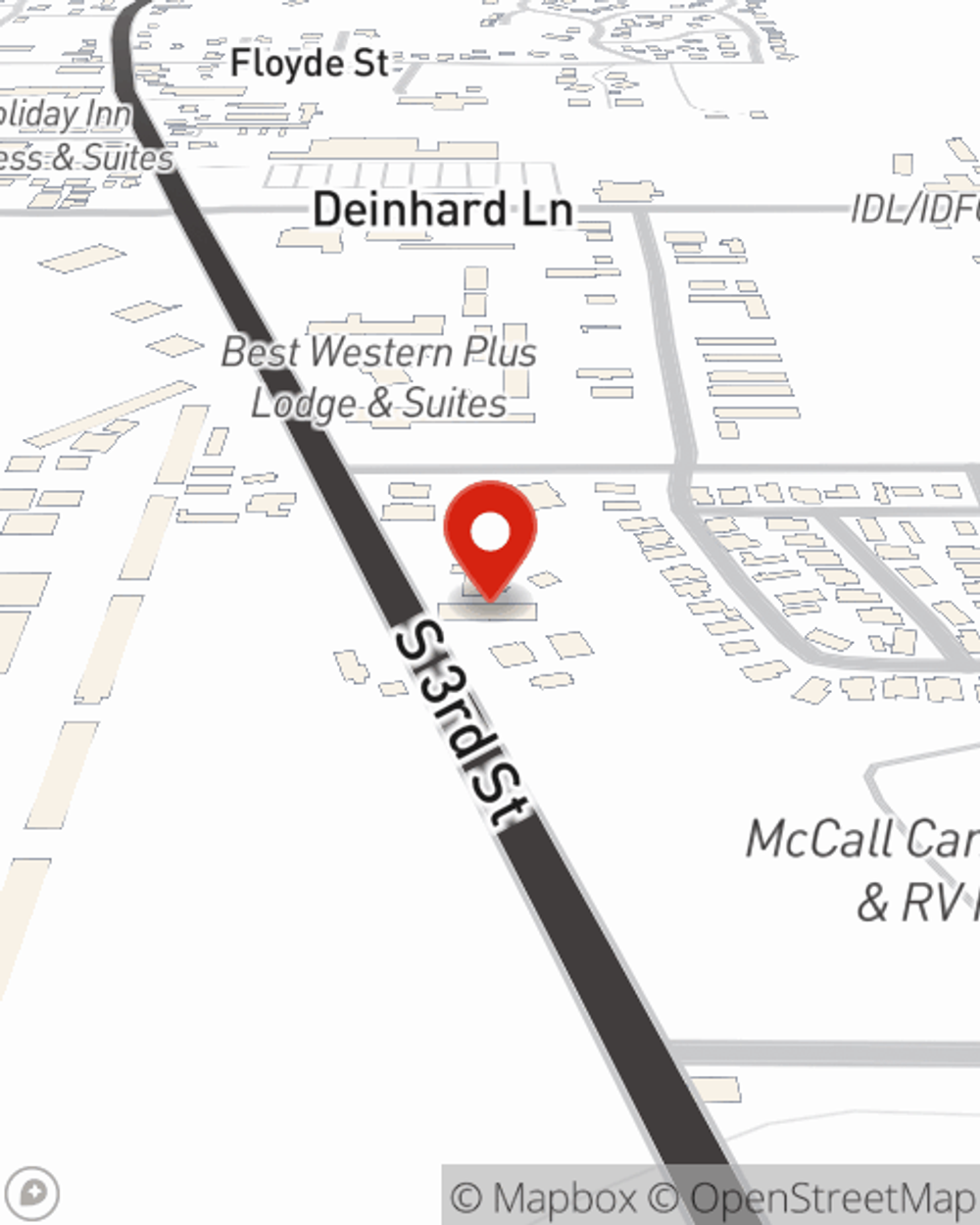

Address

McCall, ID 83638-5177

Would you like to create a personalized quote?

Would you like to create a personalized quote?

Office Info

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health, Pet

Other Products

Banking, Annuities

Office Info

Simple Insights®

Life insurance at every age

Life insurance at every age

If you’re wondering what age to get life insurance, there’s no better time than today. Let’s explore how your life insurance needs may differ by age.

Safety tips when riding a motorcycle with a passenger

Safety tips when riding a motorcycle with a passenger

Riding double on a motorcycle requires extra caution. Do your research and know what’s different when it comes to safety when you have a passenger on your bike.

Car maintenance tasks you can do yourself

Car maintenance tasks you can do yourself

To combat auto repair costs that keep climbing, some auto maintenance can be done at home. Here are ones that are usually do-it-yourself.

Social Media

Viewing team member 1 of 3

Christine Butler

Account Manager

License #21238247

Born in New York, Christine moved to Oregon at 8 and later graduated from the University of Arizona in 2003 (Bear Down!). In 2017, she made Idaho her home. Life with four kids keeps her on her toes. It is a whirlwind of joy and adventure, but she wouldn't have it any other way. She loves hiking, backpacking, paddleboarding, and skiing, and tries to take advantage of everything McCall has to offer. Christine is a licensed producer in life, health, auto, home, renters, and recreational vehicles.

Viewing team member 2 of 3

Heather Ahlstedt

Customer Relations Representative

License #20813837

Heather is a Valley County native who now works remotely out of Oregon, but is still servicing the community she’ll always consider home. Heather joined the team in 2023 to pursue her career as a licensed insurance agent. She enjoys horse-back riding, hiking, and singing. She loves the outdoors, and cherishes making memories with her 4-year-old son. Heather is a licensed producer in auto, home, renters, and recreational vehicles.

Viewing team member 3 of 3

Kelly Erickson

License #17969382

Kelly is a go-getter. She likes to work hard and play hard. Traveling internationally is a huge priority for her at this time in her life. She is curious about other countries, the people and wants to learn as much as she can. Being an Idaho native, Kelly is big in to paddle-boarding, hiking and things the typical Idaho outdoors-man (or woman in this case) loves to do. Kelly is a licensed producer in life, health, auto, home, renters, and recreational vehicles.