Office Hours

After Hours by Appointment

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health, Pet

Other Products

Banking, Annuities

Charity Andersen

Office Hours

After Hours by Appointment

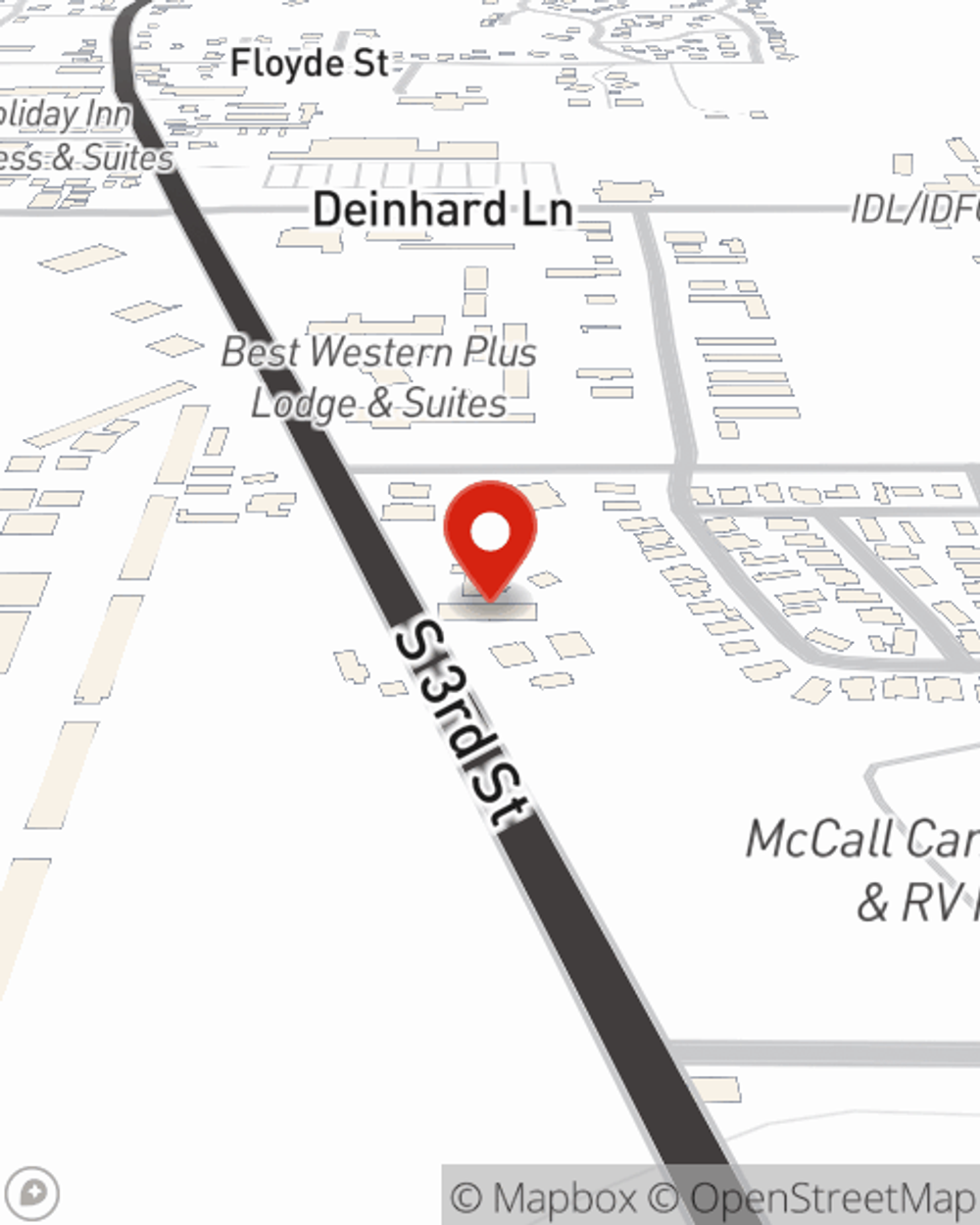

Address

McCall, ID 83638-5177

Would you like to create a personalized quote?

Would you like to create a personalized quote?

Office Info

Insurance Products Offered

Auto, Homeowners, Condo, Renters, Personal Articles, Business, Life, Health, Pet

Other Products

Banking, Annuities

Office Info

Simple Insights®

What is a will and why do you need one?

What is a will and why do you need one?

Having a Will can give you peace of mind knowing your requests will be followed with many important aspects such as your children, the choice of executor, and any special bequests.

Car maintenance tasks you can do yourself

Car maintenance tasks you can do yourself

To combat auto repair costs that keep climbing, some auto maintenance can be done at home. Here are ones that are usually do-it-yourself.

Tips for renting an apartment or a house

Tips for renting an apartment or a house

Here are some things to consider when renting an apartment to help you get ready before you move to your next rental property.

Social Media

Viewing team member 1 of 3

Christine Butler

Account Manager

License #21238247

Born in New York, Christine moved to Oregon at 8 and later graduated from the University of Arizona in 2003 (Bear Down!). In 2017, she made Idaho her home. Life with four kids keeps her on her toes. It is a whirlwind of joy and adventure, but she wouldn't have it any other way. She loves hiking, backpacking, paddleboarding, and skiing, and tries to take advantage of everything McCall has to offer. Christine is a licensed producer in life, health, auto, home, renters, and recreational vehicles.

Viewing team member 2 of 3

Heather Ahlstedt

Customer Relations Representative

License #20813837

Heather is a Valley County native who now works remotely out of Oregon, but is still servicing the community she’ll always consider home. Heather joined the team in 2023 to pursue her career as a licensed insurance agent. She enjoys horse-back riding, hiking, and singing. She loves the outdoors, and cherishes making memories with her 4-year-old son. Heather is a licensed producer in auto, home, renters, and recreational vehicles.

Viewing team member 3 of 3

Rubi Tucker

Office Representative